Cypherdude

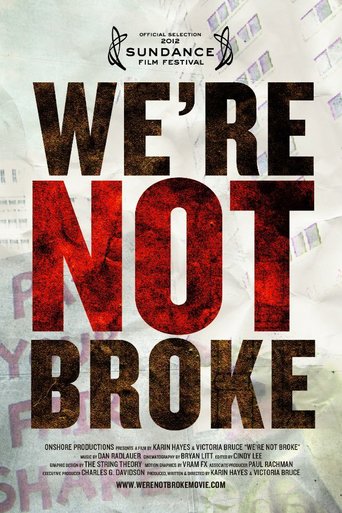

On 2/24/2014, US Defense Secretary Chuck Hagel announced major budget cuts. The number of soldiers will be cut to 440,000, the lowest since before WW2. He stated, "This is a budget that recognizes the reality of the magnitude of our fiscal challenges."Because the USA has large deficits, it can no longer pay for an optimum-sized military. Secretary Hagel stated, "American dominance in the seas, in the skies and in space can no longer be taken for granted."We're Not Broke covers how multi-national corporations have paid no US federal taxes, despite making billions in profits. With the exception of GE; CNBC, CNN, Fox News, & MSNBC have not reported this subject the way this documentary has. It is truly incredible how so little is known about this.For 2010, ALL of these multi-national corporations paid NO federal taxes: GE, Bank of America, Exxon, Chevron, Citigroup, Honeywell. These corporations had a negative income tax rate: Verizon -5.9%, Yahoo! -9.6%, DuPont -11.5%, Boeing -0.1%, Ford -1.7%. FedEx's was 0.9%. WNB does not specify what Forest Laboratories', Wells Fargo's, Verizon's, Caterpillar's, Google's or Pfizer's tax rates were.WNB reports these corporations use Transfer Pricing so they can pay lower tax rates in Bermuda, Bahamas, Cayman Islands and Ireland. Also, 100s of USA corporations have a Cayman Islands PO Box so they can pay a 0% tax rate.It costs a congressman millions, a senator $40 million and a president one billion to get elected. Most of the expense is for TV commercials. Corporations give them money and in return they vote for laws which enrich them further.Elections must be free to end most of the IMHO corruption. The government owns the radio and TV airways. During elections, we can force the media conglomerates to give free air time for candidates. Unfortunately, the rich control everything so this will never happen. On 6/7/2013, President Obama was at a fund raiser in a private house in Santa Monica taking money from all his rich Hollywood friends, again. In his speech to his rich friends, President Obama stated, he was afraid his rich donors were suffering "donor fatigue."On 1/21/2010, the Supreme Court's "Citizens United" ruling established corporations can give unlimited campaign contributions. Expect this IMHO corruption to get worse, not better. In his 2008 campaign, Obama promised he would "close the tax loopholes the lobbyists put in."Because corporations have not paid their fair share, education, police, health care, infrastructure, parks, EPA sites, everything has been cut. For the military, the most alarming is the A-10 Warthog. The A-10 is the best ground attack aircraft ever built. During the Persian Gulf War, it was the A-10 the Iraqis feared most. The A-10 provides ground troop cover in Afghanistan today.The Chinese, Japanese and British own most of our debt overseas. When they demand a 10% interest rate, we will be forced to face our huge deficits. Until then, nothing will change. Because CNBC, CNN, Fox News and MSNBC are all subsidiaries of major corporate conglomerates, these subjects will never be reported in depth by them. Another documentary you should see is "Park Avenue: Money, Power and the American Dream." It covers how the rich pay their representatives to write their laws so they can further enrich themselves on our backs, evermore.In 2012, I did not even bother to register to vote. Cypherdude. 10/10 Stars.

stormkarsten

If by watching this documentary, you were expecting some evidence that the United Sates is 'Not Broke', you will be sorely disappointed.The documentary claims closing tax loopholes can bring in $70 Billion in revenue per year. Nowhere is this paltry increase in revenue compared against the massive structural liabilities the United States faces.U.S. treasury debt is ~$17,300 Billion. U.S. unfunded liabilities are ~$125,415 Billion. Every U.S. person (man, woman, and child) owes about $400,000 each. The United States has a spending problem - not a revenue problem.1 star for accurate reporting of corporate tax loopholes. The rest is drivel, untruths, and unsubstantiated claims.

gavin6942

An exposé on how the government has allowed American corporations to avoid paying taxes and the growing wave of discontent that it has fostered.Another reviewer said this film is too one-sided, and I am afraid I have to agree with them. While I am on the same side of the political fence as the people who made this, I am unclear if the truth was told... and to me, a documentary should tell the truth. We do not need rhetoric, like corporations paying their "fair share". Is there a good reason they pay 0%? This did teach me some interesting things, though, such as about Ugland House. I have heard of the Cayman Islands and about how it is a tax shelter. I was not aware that so many of these businesses utilized the very same location. That just makes it seem even more of a scam.

heyka44

This documentary, while making a good point about economic disparities, was ridiculous. Incredible experts were brought in who made valid points about things such as transfer pricing (which is perfectly legal), but these experts were largely swept under the rug by the directors of the film.The important thing to note about the issue of the "1%" and similar groups is not that we can whine about economic disparities. The movements that did all the complaining have nearly disappeared only a short time out from when they began.The important thing to realize is that these corporations are working within their legal rights to be as profitable as possible. Corporations seek profit. It's inherent in their nature. We can't blame them for that. The problem lies in the laws that allow them to do so, and the documentary did not point that out enough.The solution is to change the laws, not glorify those who are complaining to corporations who work within their legal bounds to achieve their goal of profit production. All this documentary seemed to do was glorify those who are good at complaining, but to the wrong people.