dansandini

I'll save you the time: the "Great Moderation" that I began working during in 1984 is over. The stock market bubble became the housing bubble which became ... the Government Debt bubble (which has yet to burst). It's incredible to watch each crisis, and how each one has driven interest rates lower and lower, until we are at ... zero. We have created a scenario where we can't lower them again. Quantitative easing has kept us afloat but for how long?Inflation remains low but my understanding is the CPI no longer includes food or energy? And while unemployment has lowered my understanding is that is because people have left the workforce, and very few if any "real jobs" have been created. The films producers point out we are an economy that has consumed more than we have produced for an entire decade. They ask the question: "how long can this continue?"The film really got me thinking about a term they brought up: "moral hazard." If I know the Fed will bail me out on the downside why not accept the risk? It also applies in my mind to debt. In olden days people worried about putting debt on their children and grandchildren. That's no longer the case for many people like me. Free Heath care? Why not? Oh if an anti-viral will save me I can practice unsafe sex? Why not? I never knew it had a name but it does: "moral hazard" and I think it's becoming rapidly absent in modern society.It's especially applicable to the Justice System. I'm now officially a true crime addict. And one common thread in these horrendous cases is truly dangerous people are released into society time and time again. Criminals routinely violate their paroles with no negative consequences. Yes I'm against the "Prison State." But if we promise to punish but in the end "bail out" the truly bad guys, what are the consequences for a safe society? No easy answers.Anyway I suppose I should start a blog rather than meander in emails. This movie is kinda a snoozer but I wanted to share my thoughts.

john-4023

This film is an obvious attempt to create the illusion that the Fed is sorry for their mistakes, but they will do better in the future. I will return my DVD to the sell-out director today. The Fed is the crux of our debt, corruption and war and this film paints them as a team of financial gods who made some mistakes, but should remain in control of our monetary system. The Federal Reserve is private group of con-artist bankers and was CREATED to monopolize the monetary system of our once great country. Shame on YOU for creating this film. I suggest reading Creature from Jekyll Island to understand the background of the greatest scam ever perpetrated on the American people and the world.

Tladuca

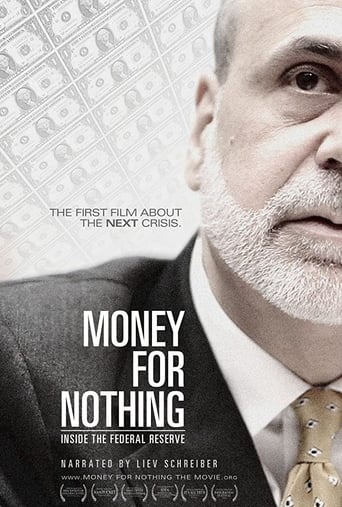

Money for nothing is an excellent, compelling, revealing and accurate look at how the FED distorts and manipulates the world economy. There are no conspiracy theories here, just the cold, hard facts. It is a sobering, unflinching look at what brought the world to the brink of collapse in 2007 and the aftermath. The movie doesn't interview former FED chairmen Greenspan or Bernanke (and really what but confusion could come from that anyway?) but lets them speak (lie) for themselves through past interviews and speeches. Interestingly included is the Fed's current chairman Janet Yellen (perhaps she had no idea she would be future chairman at the time of filming), interesting because at the end of the movie FED is portrayed has ultimately clueless and inept (and I believe it is behaving as such). Also included is a vast cast of observers and commentators; including former Fed chairman Paul Volcker, current and former regional Fed presidents, vice presidents and governors, as well as columnists, academicians, book authors and major investors whom study the Fed. Curiously absent is anyone from the current TBTF banks or any banks or businessmen at all for that matter. What the film sadly leaves out is any mention of the role of cheap energy, as if our economy exists on the back of the banking system alone! WWI is implicated in the abandonment of the gold standard when the reality was: who needs gold when you have abundant cheap energy? Just print the money you need to finance whatever you want. Future growth fueled by cheap energy will pay all the bills. The United States realized this much too late during the Great Depression, sticking to the gold standard and unable to jump-start the economy by borrowing against future growth enabled by cheap, abundant crude oil. Thus the deep flaw of this film is that the availability (or lack thereof) of cheap energy is never implicated in any of our economic problems and fortunes, as if the fed alone creates and controls economic activity. It often misattributes economic events to the actions of the Fed which are in fact more closely tied to the price of crude oil. Despite the movie's blind spot with regard to the role energy plays in the economy it otherwise leaves no stone unturned. We learn about the terrible precedent set by the bailout of LTCM and the psychology of the "Greenspan Put". Greenspan birthed the idea of a free lunch, heads you win, tails you win (the fed bails you (or whatever market you are playing in) out), all reward and very little risk. We learn how the Fed and Fed alone created the biggest asset bubble in American history. We learn what a precarious position our economy is now in despite appearances, appearances due to the distortions of the markets by the Fed. The Fed can't take away the "punch bowl" (QE and zero percent interest rates) EVER and it knows it. The fact that we print the world's reserve currency is the only thing keeping this country from disaster. The film's conclusion totally misses the fact that we are suffering from the gradual depletion of cheap energy. Some great quotes: After closing the "gold window" Nixon tells America: "What does this mean for you? You're dollar will be worth just as much tomorrow as it today" probably one of the greatest lies ever told. On Greenspan: "This alleged libertarian was presiding over the socialization of risk in our economy…" The now infamous Bernanke quote (in perfect context): "The problem in the subprime market seems likely to be contained" (March 2007!) Greenspan: "I've always believed we underestimate the impact of stock prices on economic activity, (open bracket)…(close bracket) if (open bracket) the stock market (close bracket) continues higher this will do more to stimulate the economy than anything (open bracket) else could (close bracket)." Greenspan (2011): "The United States can pay any debt it has because we can always print money to do that, so there is zero probability of default." The games the Fed is playing with our economy can only last for so long.

Augustus Gustavius Salvatore Calabrese

The movie is long ( 100 minutes ) , boring , dis-ingenuous. The actual content is about 1/3 of the movie and the other 2/3 is filler material. Many concepts are repeated over and over until the eyes begin to glaze over. There are lots of emotive images that do not inform. There are lots of talking heads that add little to the movie. I found myself wondering if the producer was cynical and aware of the manipulation occurring. Or maybe the producer thought all the stuff included was *cool*. The movie has laser beam focus on the Federal Reserve and ignores all other factors. The movie contradicts itself. The movie is full of logical fallacies. ( Are they deliberate ? ) The best element of the movie is the remark that the *US currency* is the world's best brand name. 99guspuppet