Desertman84

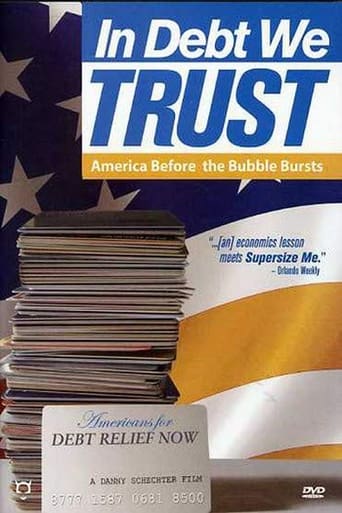

Danny Schechter investigates mounting debt crisis that Americans are facing in this documentary entitled,In Debt We Trust.It informs the viewer on how many Americans are becoming dependent on credit cards and how this could affect them in the years to come with frightening consequences. The documentary reveals how credit card companies,lobbyists,the media and President George W.Bush's administration have conspired to the deregulation of the lenders to maximize the dependency of Americans on credit cards and to firmly establish the culture of credit in to the American lifestyle. It also informs the viewer the how financial and political complexities brought about to Americans to become in debt so that they find themselves being involved in maxing out credit cards,bankruptcies and house repossessions.Interviews were made to educate viewers of how politicians and lenders made this happen.Added to that,we also get to know how young people get burdened with so much debt with respect to student loans before to get into their first job. As all of these are discussed,we get to see how this will eventually affect the society and country in terms of economic stability and eventually the global economy considering that the world is dependent primarily on the United States' economy.What makes this documentary good is the fact that it provides information not only on what currently happening when in the lending industry and the government but it also provides information to the public on how to empower themselves to avoid the traps of debt dependency.While some may find this basic information that the consumer should already know,people with limited knowledge on credit will find this highly informative on decisions they should make in the future when it comes to money and credit and definitely entertaining as they makers of the documentary made it easy to understand.

david-sarkies

I have watched this before, but when I watched it last night this film basically scared the hell out of me. It is not because I am in debt, or am tempted to get into debt, but rather how the modern financial institution is creating a new feudal class system where the lower class is enslaved through debt. Now this is not necessarily the case here in Australia where we have a minimum wage, and free healthcare (to an extent, but at least it is affordable, when you have health insurance that is) so some of the reasons why people get into debt into the United States simply does not occur here (though with our current government we could quite easily begin heading in that direction).However, I have been toying with the idea of taking out a mortgage to purchase a home (though I have a substantial amount of savings, as well as a pretty decent deposit) and after watching this film it made me wonder whether I should go ahead with this. I should remember though that what is being talked about here is consumer debt, not mortgages (which are tied to a physical asset which generally gains in value). Okay, I may never actually own the full title to my home, but in a way it is something that I will probably not aim to do simply because there may come a time when I wish to liquidate it (and some people do that and move to a country where they can live like kings).I think the problem is, and this is outlined in the film, that the economy is supposed though consumer activity, and when the consumers run out of money they can no longer purchase stuff, and as such they need to be given money (through debt) so that the economy doesn't collapse. This has a knock on effect of enslaving these people because in many cases they do not have the ability to pay it back. Financial institutions spend millions of dollars selling debt and creating the impression that we can have the good lifestyle now through the use of credit. However I basically eschew consumer debt because it is a debt based on nothing (though have in the past almost fell into that trap, and it was only through God's intervention that I did not get my hands on that credit card).The other interesting thing that is raise is that the idea that governments and corporations get into debt with the intention of never paying it back. We are not talking about small businesses (who have a line of credit) but mega corporations that effectively function like governments. These companies continue to raise debt and that debt is issued in the form of bonds, and even though those bonds have an expiry date, the corporations end up rolling them over into new bonds. They never intend on paying that the full value of those bond (ie redeeming them) but end up keeping them in perpetuity, until such a time as the company can no longer pay the interest and goes bankrupt.It is a shame that we can't operate like a company, but then again companies, while being an entity, are a different beast than humans, and can exist as long as they are able to pay the interest on that debt. Once the company can no longer pay the interest, the company effectively dies.

robert-temple-1

This documentary has a title which plays ironically upon the motto of the United States, which appears on coins: 'In God we trust.' The theme is that debt, in the form of credit addiction, has now largely taken the place of God in America, and Debt is indeed a wrathful god! The film indirectly predicted the financial collapse of 2008 two years before it happened, so it is an extremely important historical document which lays bare what was happening, and hints at what was about to happen, and did. A man interviewed in the film describes and criticizes those strange inventions of financial fraudsters known as 'securitisations'. Probably no one seeing the film at the time knew what he was talking about, but we all know now. 'Securitisations' were ways of packaging bad debts into complicated bundles which were 'sold as debt' to banks and investors. The man describes the process: you take a house worth $400,000, give a loan against it of $800,000 which you know can never be repaid, then incorporate that bad loan in something complicated called 'securitisation' and sell it to a sucker. You then have sold the worthless debt and have cleared your own investment. This is straightforward fraud, of course, but since this happened many thousands of times and was done by all the leading banks and lenders, and the entire financial system was implicated, no one has been prosecuted, and all the bad debts were simply passed on to the taxpayers, and everyone involved in the gigantic scam got their money in the form of what is euphemistically called 'bail-outs'. So the crooks won and will never be punished. The ultimate suckers were the public. If you look more closely at what happened at the Government level, let us consider the case of Hank Paulson, Secretary of the Treasury, who was given the power to decide who would get how much 'bail-out'. He was the former CEO of Goldman Sachs. Of course it is pure accident that he gave Goldman Sachs billions and billions of dollars. When at Goldman Sachs his main competitor was Lehmann Brothers. Of course it is also pure accident that Lehmann Brothers got nothing and was allowed to collapse. I have never seen anyone in the financial press ever even whisper the words 'conflict of interest'. Perhaps they don't know what those words mean. Hank Paulson must therefore be some kind of hero, don't you think? If your name is Goldman or it is Sachs? But this film mainly deals with credit cards and accuses the credit card companies and banks of trying to turn the entire nation of America into credit junkies, at which they have admirably succeeded. Indeed, the intention to attach lifelong debt to every human being on the planet is well underway. What better way to control people? In this film there is an interview with a family who were sitting having lunch one day when a law enforcement officer turned up and said they had ten minutes to get out of the house, as it was being repossessed. They had to leave all their clothes and belongings behind, and the lunch sitting half eaten on the table. Yes, 'in God we trust', for there is only God left when the system is so rotten, the culture so corrupt, the exploitation of every citizen so ruthless, that children can have their lunch ripped from their mouths and be thrown onto the street without a possession to their name. That is America today. The film then goes on to explain how all the politicians in Washington depend upon the banks and financial institutions for their campaign money so refuse to do anything to stop this credit mania which is destroying the country. The film criticises the national debt for being out of control, but it is now five years later and it is still rising insanely. The film explains that America has become a nation of consumption, and that two thirds of its GDP is money spent internally on consumption and hence not earned from outside (and this is funded by the Chinese buying American bonds so that the American economy does not collapse because if it does China, which is based upon exports, might then collapse too because of being unable to continue selling to America). This is a sick, rotten, and wholly unsustainable situation, of course. The film shows how credit card companies and banks are targeting teenagers and offering them credit cards, in order to habituate them to living on credit, and becoming indebted for the rest of their lives. Many horrifying examples and case histories are given. One girl in her twenties who has 'gone straight' cheerfully says it will only take her six more years to clear her debt and then she will be 'free'. But will she? Will anybody? How long can this go on? The crash we have had so far is nothing compared to what must be coming. I was horrified to see that a Canadian reviewer has viciously attacked this film and called it worthless. He must work for a credit card company! The film was made on a very low budget by an investigative journalist called Danny Schechter, and its production values are not of the highest. But he should not be criticised, he should be praised for going to all this trouble to try to warn the unheeding and mindless public who are rushing towards their doom by living a lie and are the sacrificial victims of corrupt politicians, financiers, and bankers, who themselves will be ruined when the whole system comes down around their ears, bringing everything we think of as 'modern civilisation' with it. It will be very grim when it happens, very grim indeed. But at least people will stop chattering nonsense to each other on their cellphones at last and be forced to face something they don't at the moment know exists, known as Reality.

nederhoed

This documentary shows the influence of debt in everyday life. From consumer dependence, credit card advertisement, the economic system to politics and law.This documentary was definitely worth watching. It informs about the forms of debt you get offered by corporations, showing all consequences of the deal. It sheds light on the dark side of consumer debt.What surprised me is that no other reviewer mentions that this documentary predates the 2008 economic collapse. It tells about sub-prime loans, reselling of mortgages by banks and the uneven battle between individual consumers and big corporations.